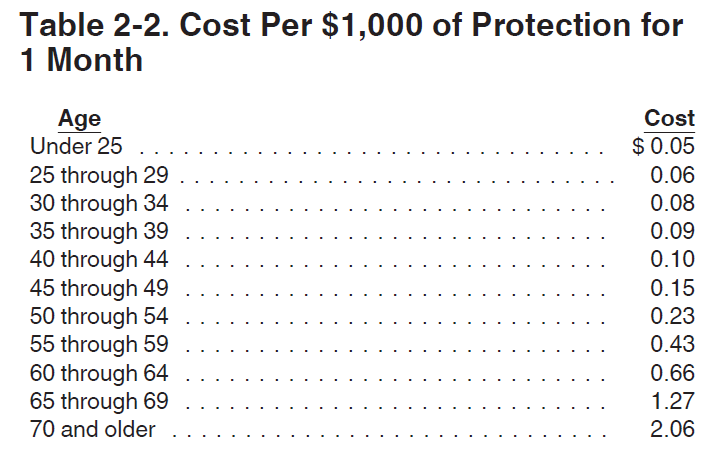

The holidays are quickly approaching and the year-end is right around the corner. Before running the last payroll of the year, business owners not only need to make sure they have completed any W-9s for vendors that will be receiving 1099s, as well as make sure that any taxable fringe benefits are included in the owners and employees W-2s. Given the vast number of fringe benefits offered and how they are taxed, it can be confusing determining what is to be included in wages.

Lauri A. Lisanti, CPA, MAcc, CPS, Certified QB ProAdvisor

Recent Posts

Calculating Fringe Benefits for W-2s.

Topics: Tax, Fringe Benefits

QuickBooks Tips | Going Mobile

With the increased usage of smartphones and tablets, many clients ask if they can use QuickBooks on their mobile devices such as a smartphone and tablet. The answer is yes; however, it does depend on which version of QuickBooks the client is using.

Topics: QuickBooks Expert, Quickbooks Tips

QuickBooks Tips | Transferring Data to Your Accountant

What is the best way to send my accounting data to my accountant so that they can prepare my tax return?

The answer is not the same for every client. Clients often send a copy of their financial statements without realizing that it's insufficient. From the accountant’s perspective, it is much more efficient to have a copy of clients' QuickBooks file so that the information needed is right at their fingertips.

Topics: Advice from a Certified QuickBooks Proadvisor, QuickBooks Expert, Quickbooks Tips

QuickBooks Tips | Managing Cash Flow Using the Vendor Center

Topics: Certified QuickBooks Proadvisor, Quickbooks Tips, Bookkeeping

QuickBooks Tips | How to Fix Duplicated List Items

Using QuickBooks requires the creation and maintenance of lists such as customer, vendor, chart of accounts lists. Frequently, clients come across a scenario where they find duplications within these lists. For instance, they find two slightly different versions of the same customer or vendor.

Unfortunately, this can become a data management nightmare. Applying payments to a customer's account, pulling a report to determine if a vendor should receive a 1099, or posting a transaction to a general ledger account, etc. when there are active duplications in the necessary lists will result in potentially major errors.

This issue seems to be more prevalent when more than one person has access to the QuickBooks® data. One person may not see the name already created in the list by another individual and will proceed to create another. QuickBooks has a built-in feature to prevent this. A warning message should appear indicating the name is already in use and asks would you like to merge them. However, even the slightest variable in how the names are entered will bypass this feature. It only takes one small difference in the name to create a new one. An example is putting a middle initial in a name of an individual or a comma in the name of a business.

Topics: Certified QuickBooks Proadvisor, Quickbooks Tips, Bookkeeping

QuickBooks Tips | Memorizing Transactions

Businesses can make any number of transactions in a given year. A transaction being any business agreement or exchange that one makes with another person or business. To minimize mistakes and increase efficiency business should utilize QuickBooks to memorize transactions.

QuickBooks Memorized transactions:

Instructions on memorizing QuickBooks transactions.

Topics: Advice from a Certified QuickBooks Proadvisor, Quickbooks Tips, Bookkeeping

QuickBooks Tips | Using Class Tracking

What is QuickBooks Class tracking?

Class tracking is a feature in QuickBooks that enables you to keep track of your transaction data by creating classes to categorize them.

What is a class?

Classes are assigned to transactions that relate to one another by category. For instance, many clients have a need to track income and expenses by categories such as, department, business segment, location, etc.

This feature is the best way for a business to separate any significant segments of the business without having to add additional income and expense accounts to the general ledger.

Examples:

- For profit companies may want to track multiple locations or divisions of the company.

- Not-for-profit companies may need to track grants and restricted and unrestricted funds.

- Any company doing business with a governmental entity can use classes to track fixed priced jobs versus cost plus jobs versus overhead.

Topics: Advice from a Certified QuickBooks Proadvisor, QuickBooks Expert, Quickbooks Tips

QuickBooks Tips | Budgeting and Forecasting

QuickBooks® offers a module to make the process of preparing and updating a budget or forecast easy. At a time when clients are reviewing their goals and objectives, be it monthly, quarterly, or annually, the process often includes the preparation of an operating budget and/or financial forecast.

What is financial forecasting?

"Forecasting is the use of historic data to determine the direction of future trends. Businesses utilize forecasting to determine how to allocate their budgets or plan for anticipated expenses for an upcoming period of time. This is typically based on the projected demand for the goods and services they offer." - Investopedia

Topics: Certified QuickBooks Proadvisor, Quickbooks Tips, Using QuickBooks

QuickBooks Tips | Which Version is Right for Your Business?

This is the second of multiple posts in a series on using QuickBooks. QuickBooks holds the largest market share of accounting software in the United States. Yet there are many other accounting software options available and we encourage you to explore the Best Accounting Softwares for your business.

This post discusses the benefits of accounting software versus manual accounting practices.

There are many versions of QuickBooks on the market. There are versions of QuickBooks that range from the most basic, which is like a check register, to a more sophisticated version to imitate an enterprise planning “ERP” system.

Topics: Certified QuickBooks Proadvisor, QuickBooks Expert, Quickbooks Tips, Using QuickBooks

QuickBooks Tips | Increase Your Business's Efficiency

This is the first of multiple posts in a series on using QuickBooks. QuickBooks holds the largest market share of accounting software in the United States. Yet there are many other accounting software options available and we encourage you to explore the Best Accounting Softwares for your business.

Topics: Certified QuickBooks Proadvisor, QuickBooks Expert, Quickbooks Tips, Using QuickBooks