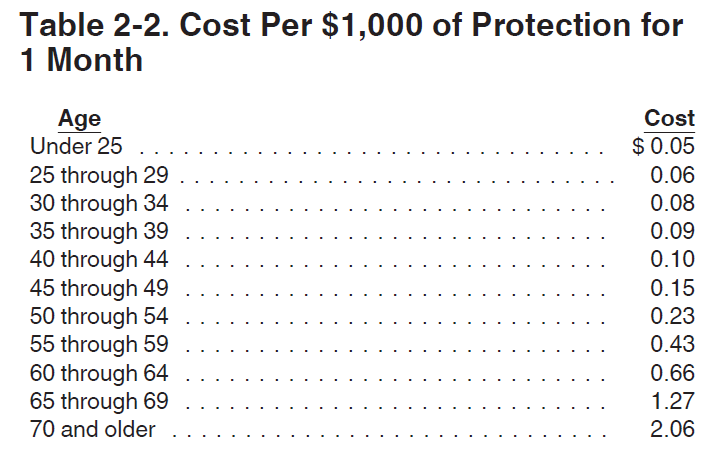

The holidays are quickly approaching and the year-end is right around the corner. Before running the last payroll of the year, business owners not only need to make sure they have completed any W-9s for vendors that will be receiving 1099s, as well as make sure that any taxable fringe benefits are included in the owners and employees W-2s. Given the vast number of fringe benefits offered and how they are taxed, it can be confusing determining what is to be included in wages.

Calculating Fringe Benefits for W-2s.

Topics: Tax, Fringe Benefits

Top 10 Ways Your 2018 Taxes Could Change | A Tax Cut and Jobs Act Overview

In 2017 President Trump signed the Tax Cuts and Jobs Act. As a result, there are many changes to the tax code which will affect us this tax season. Now that the 2018 tax year is almost over, you’ll want to start planning how this new tax provision will affect you. Below is a brief run-through of the most critical changes that are effective beginning with your 2018 tax return.

Topics: Tax Filing Requirement Changes, Tax