In 2017 President Trump signed the Tax Cuts and Jobs Act. As a result, there are many changes to the tax code which will affect us this tax season. Now that the 2018 tax year is almost over, you’ll want to start planning how this new tax provision will affect you. Below is a brief run-through of the most critical changes that are effective beginning with your 2018 tax return.

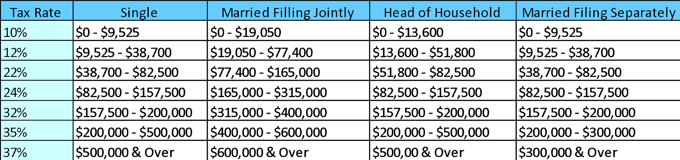

1. 2018 Tax Brackets

Unchanged under the new provision is the number of tax brackets a taxpayer could potentially fall under. The new provision still maintains seven brackets; however, most individual income tax rates are now lower within each bracket. Under the new regulation the tax brackets are as follows:

2. Standard Deduction/Personal Exemption

Under the new tax provision, standard deductions for all taxpayers increase significantly, nearly doubling. The new deductions are as follows:

- Individuals - $12,000

- Head of Household - $18,000

- Married Filing Joint - $24,000

Personal and dependency exemptions have been eliminated.

3. Alimony

Any divorce or separation agreements signed or modified on or after January 1, 2019, under the new tax provision, the taxpayer that makes alimony or maintenance payments does not get to deduct these amounts. On the contrary, the party receiving these payments no longer has to claim amounts received as income. Keep in mind that for 2018 returns, alimony or maintenance payments may still be deducted and the party receiving the payments will still need to claim the amounts as income.

4. Health Insurance Mandates

The new tax law repeals the shared responsibility payment for taxpayers who fail to carry health insurance for the full year. However, it is important to note that this change does not go into effect until 2019. All taxpayers must have some form of insurance for all of 2018 to avoid paying this penalty.

5. Medical Expenses

More medical expenses are deductible for 2017-2018. The floor is now 7.5% of the adjusted gross income (AGI). For example, if you have AGI of $100,000 the first $7,500 of your qualifying medical expenses are not deductible. If you have a total of $10,000 in qualifying medical expense, then only $2,500 can be deducted. After 2018 the floor will increase to 10% of the AGI.

6. Mortgage Interest

For new mortgages or home equity loans obtained after December 15, 2017, taxpayers are allowed to deduct interest on $750,000 of debt. Prior to the new tax act, the deduction was limited to interest on debt balances up to $1 million. Any interest from a home equity line of credit not used to buy/build/or improve the home cannot be deducted. Also, interest is not deductible if a home equity loan is used to pay off credit cards or other personal expenses.

7. State and Local Taxes

There is now a cap on the state and local tax deduction of $10,000. These deductions include income tax withholdings, estimates, overpayments credits and many more. Also included in the $10,000 cap is real estate taxes paid. Many taxpayers will see a significant decrease in itemized deductions starting in 2018 due to this new law.

8. Miscellaneous Itemized Deductions

All itemized deductions that were subject to the 2% threshold of adjusted gross income are no longer deductible. Some of these deductions include tax preparation fees, investment expenses, and unreimbursed employee expenses.

9. Child & Dependent Tax Credit

Under the new the provision, the child tax credit has been increased to $2,000 per qualifying child with $1,400 of the credit possibly refundable. This is a credit and not a deduction meaning that it is a dollar-for-dollar reduction on the amount that a taxpayer could potentially be obligated to pay.

To be eligible for this enhanced child tax credit the following criteria must be met:

- Your child must be under the age of 17

- You must provide more than half of his/her support

- Your child must reside with you for more than six months of the year

Income also plays a factor in whether or not you are eligible for this credit. For married filing jointly taxpayers, income must be under $400,000. All other tax payers must have income less than $200,000 to be eligible.

There is also a nonrefundable credit of $500 for qualifying dependents. To be considered a qualifying dependent the following criteria must be met:

- Cannot qualify for the child tax credit

- Reside with the taxpayer for a full year OR be a relative of the taxpayer

- Gross income of the dependent must be under $4,150

- The Taxpayer must provide more than half of his/her support

- Only one taxpayer can claim a dependent.

10. Alternative Minimum Tax

The alternative minimum tax (AMT) was initially implemented to ensure that higher-income Americans pay their fair share of taxes despite the amount of deductions taken. This requires many households to calculate their tax due under AMT rules as well as the rules for regular income tax, with the result of having to pay the higher of the two amounts calculated. Under the new tax provision, AMT exemption amounts have increased as follows:

- Single or Head of Household - $70,300

- Married Filing Jointly - $109,400

- Married Filing Separately - $54,700

Furthermore, the income level at which these exemption amounts begin to phase out has significantly increased. The new provision raises phase-out amounts to $1 million for married filing jointly taxpayers and $500,000 for all other taxpayers.

Significant changes have been made with the implementation of the Tax Cuts and Jobs Act of 2017. It can be difficult even for the professionals to keep track of such tax changes. If you have any questions or comments on how we can improve our post or help you this tax season feel free to either leave us a comment below or contact us here.