Many of us use our personal vehicle for business purposes to one extent or the other. This doesn't seem fair since the added miles can reduce the value of your vehicle and reduce your equity, not to mention other associated costs you might pay for out of pocket. Because of this, the Internal Revenue Service (IRS) allows taxpayers to recover the costs associated with the business use of a vehicle. We'll discuss the two methods of recovering the costs associated with the business use of a vehicle.

Deducting vehicle expenses:

There are two methods for deducting vehicle expenses:

- the standard mileage rate or

- the actual expense method.

(whichever yields the greater deduction).

The Standard Mileage Rate for 2018 is 54.5 cents per mile.

To use the standard mileage rate, multiply the mileage rate by the number of business miles driven.

For example, assume you drove 15,000 total miles during 2018. 10,000 of those miles were for business. The taxpayer would have a vehicle deduction of $5,450 (10,000 x .545).

Note: miles earned from commuting to and from a place of employment are not business miles. According to the Internal Revenue Service, your miles earned during your daily commute are personal.

The Actual Expense Method:

To use the actual expense method; divide the total miles driven for the year by the total number of business miles driven, also known as the business use percentage. Then apply the business use percentage to the actual expenses of owning or operating the vehicle. Such costs include fuel, oil, tires, repairs, insurance, registration, and depreciation.

Using the same example as before, the individual’s business use percentage would be 66.7% (10,000 business / 15,000 total).

Note: You must maintain documentation to support business and personal mileage. We recommend keeping a travel log. The travel log should detail the time and place of travel, purpose of the business travel, and the amount of expenses incurred during the travel. Also, keep track of receipts for any additional expenses.

Depreciating vehicles:

The second method of cost recovery for business vehicles includes depreciation expense. Depreciation expense for business vehicles can be more complicated due to gross vehicle weight (GVW) requirements, as well as accelerated depreciation rules.

Generally, business vehicles are depreciated under the Modified Cost Recovery System (MACRS) over a period of 5 years. There are certain limitations under Section 280F. Before 2018, trucks and SUVs had separate limitations. However, due to the recent Tax Cuts & Jobs Act (TCJA), Section 280F limitations are now the same for passenger autos, trucks, and vans.

Passenger vehicles, trucks, or vans that are 6,000 lbs or less:

Any passenger vehicle, truck, or van that is 6,000 lbs or less can only take a first-year depreciation expense deduction in the amount of $10,000. However, if using the accelerated method (bonus or Section 179) the amount of first-year depreciation is increased to $18,000. That is the maximum first-year deduction allowed.

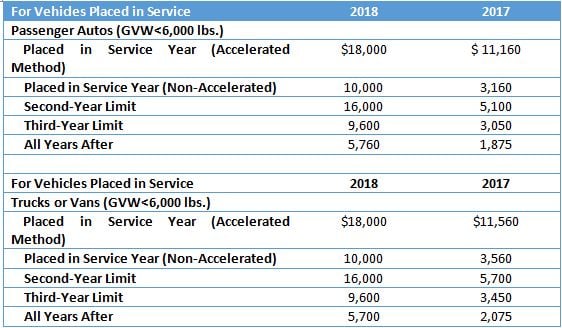

See the chart below for a summary of annual depreciation allowed on business vehicles.

Vehicles between 6,000 and 14,000 pounds:

Any vehicle between 6,000 and 14,000 pounds gross vehicle weight will not be subject to any depreciation limit previously discussed and should be depreciated using the MACRS method over a period of 5 years. However, if using the accelerated depreciation methods, the most first-year depreciation allowed is $25,000.

Also, keep in mind that the amount of the depreciation expense is limited by the vehicle’s business use percentage (discussed previously).

In previous years, business vehicles that were traded-in were required to defer the gain or loss under the like-kind exchange rules. However, the Tax Cuts & Jobs Act of 2018 eliminated this requirement. Under the new guidelines, all vehicles that are traded-in must recognize a gain or loss in the year of the trade-in.

There are two basic ways to recover the costs associated with the business use of your vehicle. The IRS has developed guidance and materials available to taxpayers that describe these rules in more detail.